By Linda Sutter – December 17, 2021

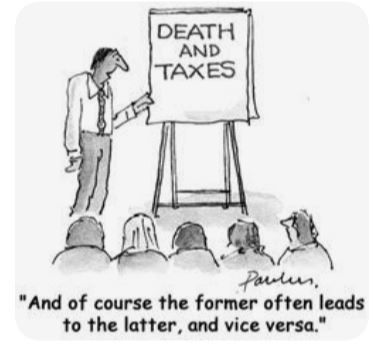

Our local officials thought it was great fun to use our taxpayer funds to place a one cent sales tax on the ballot last year, increase Fire District tax on a few to pay for all, and now want to increase our water and sewer rate in the County and Bertsch Tract, and let’s not forget how the Del Norte Unified School district squandered $25 million dollars and we still owe $44 million.

In essence, our property tax has gone up, our sales taxes have gone up along with inflation food prices, gas prices, and other goods, and let us not forget how much empathy the Board of Supervisors stated this past Tuesday, as they openly expressed their concern for the elderly who are homeless, but didn’t mention to make elderly property owners tax exempt.

No siree bob. They are sorry to kick people out in the street, but not too much.

Most property owners in Del Norte County do not make $40,000 per year. A lot of us are 65 years and older. Some of us are Veterans. With that said, let’s talk about tax-exempt Homesteading.

Before I get started on this write-down form BOE-266 claim for homeowners tax property exemption, which can be obtained by Del Norte County Recorder’s office.

The following information came from the California Board of Equalization;

505.0065 Mobilehome:

A mobile home owned by its occupant is eligible for the homeowners’ exemption if it is otherwise subject to property tax, but the leased land on which it is situated is not, even if the lease is for a period of 83 years. While the execution of a lease for 35 years or more is cause for a reappraisal for change in ownership purposes, a lessee is not an owner for exemption purposes.

C 3/6/1989.505.0090 Rented Mobilehome on Owned Land:

The exemption is not available to a person occupying a rented mobile home on land he owns and with respect to which mobile home he has claimed a renter’s credit.

C 6/16/1978.505.0078 Principal Residence:

Whether a dwelling located in California is a person’s principal place of residence is a question of fact. To qualify for the exemption, a dwelling must be the person’s true, fixed, and permanent home and principal establishment to which he/she, whenever absent, intends to return. In-state presence, vehicle registration, voter registration, bank accounts, and state income tax filings are among the matters to be considered in determining residency, which, for exemption purposes, is equivalent to domicile.

C 11/20/1984.505.0110 Trailer Coach:

The exemption applies to a trailer coach and parcel on which it is located if owner-occupied on the lien date and listed on the assessment roll, and to appurtenant structures, e.g., cabana, storage shed, etc., owned by the trailer coach owner. Where a person resides in a licensed trailer coach on his own land, the exemption applies only to the parcel on which the trailer coach is located.

LTA 3/23/1982 (No. 82/50).505.0130 Types of Property:

An owner-occupant of any of the following types of property may qualify for the exemption with respect to that portion of the property occupied:1. A rooming house.2. A duplex. If owned by a two-member partnership where each side is a principal residence, each side would qualify.3. A multiple-family residential property.4. A motel.5. An apartment in a structure owned by a nonprofit corporation or cooperative housing corporation.

LTA 3/23/1982 (No. 82/50).505.0135 Under Construction:

The exemption should not be allowed on a dwelling under construction if the owner lives elsewhere and plans to move into it when completed. However, if the owner actually occupies the dwelling as his principal place of residence, he may receive the exemption. If the owner does not occupy the dwelling under construction but lives in a trailer coach or other abode on the property, no part of the exemption may be applied to the dwelling under construction. The exemption may be applied to the abode or to the land on which the abode is located. If the owner is occupying an existing dwelling and is remodeling or adding to it, the exemption should be allowed on the assessed value of the entire property.

LTA 3/23/1982 (No. 82/50).505.0140 Vessel:

While Revenue and Taxation Code section 218 permits the application of the homeowners’ exemption to personal property, there is nothing in its language to indicate that a vessel qualified for the documented vessel exemption contained in Revenue and Taxation Code section 227 may qualify for both exemptions at the same time. The vessel owner must elect and properly claim one of the exemptions.