Opinion Piece By Donna Westfall – January 18, 2023

With new Arkansas Governor Sarah Huckabee Sanders, President Joe Biden got’s big trouble. Her first week in office she has accomplished this:

- banned critical race theory from public schools

- ordered a reduction of state government rules and regulations, called for cutting of waste in unemployment insurance, enacted a state hiring freeze and ordered protection of technology from adversaries like China.

- “As long as I am your governor, the meddling hand of big government creeping down from Washington DC will be stopped cold at the Mississippi River.”

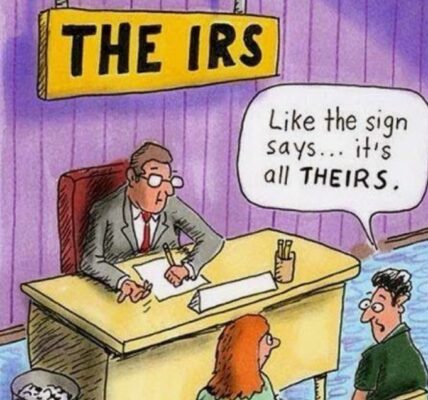

How about the meddling hands of big government with taxes on nearly everything. If it’s not federal it’s state taxes. But getting back to Biden, making him even unhappier is the threat of abolishing the IRS.

Rep. Earl “Buddy” Carter (R-GA), introduced The Fair Tax Act which passed the House with 223 Republican votes vs 210 Democratic votes. Here’s the summarized version:

Introduced in House (01/09/2023)

FairTax Act of 2023

This bill imposes a national sales tax on the use or consumption in the United States of taxable property or services in lieu of the current income taxes, payroll taxes, and estate and gift taxes. The rate of the sales tax will be 23% in 2025, with adjustments to the rate in subsequent years. There are exemptions from the tax for used and intangible property; for property or services purchased for business, export, or investment purposes; and for state government functions.

Under the bill, family members who are lawful U.S. residents receive a monthly sales tax rebate (Family Consumption Allowance) based upon criteria related to family size and poverty guidelines.

The states have the responsibility for administering, collecting, and remitting the sales tax to the Treasury.

Tax revenues are to be allocated among (1) the general revenue, (2) the old-age and survivors insurance trust fund, (3) the disability insurance trust fund, (4) the hospital insurance trust fund, and (5) the federal supplementary medical insurance trust fund.

No funding is authorized for the operations of the Internal Revenue Service after FY2027.

Finally, the bill terminates the national sales tax if the Sixteenth Amendment to the Constitution (authorizing an income tax) is not repealed within seven years after the enactment of this bill.”

Here’s the controversy:

Rep Carter said “Instead of adding 87,000 new agents to weaponize the IRS against small business owners and middle America, this bill will eliminate the need for the department entirely by simplifying the tax code with provisions that work for the American people and encourage growth and innovation,”

Biden contends,

“They want to raise taxes on the middle class by taxing thousands of everyday items from groceries, gasoline, clothing, and cutting taxes for the wealthiest, because they want to supplant the money lost from taxes on the millionaires and billionaires with a sales tax on virtually everything in the country,” adding still… “You know, all these new IRS agents we have is because they fired a lot of them, and a lot are retiring,” and finally “Let me be clear: If any of these bills happen to reach my desk, I will veto them,” – “Any of them.”

Of course Biden has promised to veto anything having to do with changing or abolishing the IRS. With 87,000 new agents heads on the chopping block, seems to me he will not be able to weaponize the IRS like he has the FBI and DOJ.

Consider this. Since when is Biden concerned with the middle class? His actions from Day 1 of taking office prove just the opposite. How many billions of dollars worth of equipment and armaments did he leave in Afghanistan? He didn’t think that one through very carefully now did he? How about shutting down the Keystone Pipeline. Another bad choice. Thousands put out of work and just the first domino to fall down in getting our nation into hot water with gas prices; which is dependent on oil prices which is dependent upon supply and demand.

Seems to me that stickers like: Get Rid of Organized Crime; Abolish the IRS” and “Taxation is Theft”… should be very popular right now. Getting rid of the IRS would shift the burden to the States. This should save money for the federal government by reducing all the jobs connected to the IRS, and then increase costs to the states to assume the burden. The costs would need to be calculated.

I, for one, would welcome the change. On July 1, 1862 the IRS was created. Since then, IRS codes have become so complicated, it takes a CPA or tax specialist just to do your taxes each year. And then there’s always the threat of an audit hanging over your head. Plus due to Covid, the IRS is backlogged about 12.4 million returns to process, resulting in refund delays for millions of taxpayers (as of late September 2022).

Abolishing the IRS is not a new idea. Going to a Fair Tax isn’t either, but with the Senate now controlled by the Democrats, I hope for the best, don’t see this going anywhere in the near future. But, let’s say it does pass and it handed up to Biden. He holds the VETO stamp all poised to come crashing down on The Fair Tax Act of 2023. (Note: There isn’t an actual VETO Stamp. He simply does not sign it.)

Is there anything else that can be done to override his decision? Yes, but it’s not promising either. If two-thirds vote in Congress (House & Senate) to override, it can be done.

Lastly, let’s look at the Inflation Reduction Act (inappropriately named) which to this day I’d bet money that most of our legislatures did not read. The part that grabs my interest is the BILLIONS to be spent hiring 87,000 agents to hire customer service agents and tax workers who could help answer questions and speed the agency’s handling of returns. New auditors would also be hired, but the Biden administration has said they would mostly focus their scrutiny on people earning $400,000 or more — not middle- or working-class Americans. Do you believe that?

For an agency that has been in existence for over 161 years you would think they would have better technology and systems in place to deal with the millions of returns by the taxpaying public. Instead here’s a list of problems according to National Taxpayer Advocate Erin Collins:

- Delays processing tax returns.

- Tax code complexity: Collins said byzantine laws create a “costly and time-consuming” process for taxpayers.

- IRS hiring and training: The IRS budget has shrunk by 15% in the last decade, leading to staffing levels last seen in the 1970s and creating declines in service quality.

- Telephone and in-person service: Only 1 in 10 calls got through to an IRS agent in fiscal year 2021.

- Online access for taxpayers and tax professionals: Collins said the IRS websites lack functionality.

- E-file and free file: The report notes that not all IRS forms are compatible with e-filing, which means some taxpayers are forced to file paper returns, leading to processing delays.

- IRS transparency: Collins dings the IRS for failing to provide taxpayers with basic information, such as why their refund was delayed.

- Return preparer oversight: The report noted that taxpayers are frequently harmed by non-credentialed return preparers.

- Appeals: Taxpayers who want the IRS Independent Office of Appeals to review their case have an average wait of a year.

- Overseas taxpayers: Americans who live abroad face a number of hurdles to file their taxes, such as barriers for e-filing.