BY DONNA WESTFALL

Credit to THE SOLAR FOUNDATION

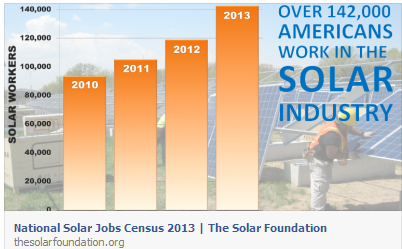

On January 27th, 2014, The Solar Foundation released its highly anticipated National Solar Jobs Census 2013, which found that the U.S. solar industry employed 142,698 Americans as of November 2013. This figure includes the addition of 23,682 solar workers over the previous year, representing 19.9 percent growth in employment since September 2012. During the period covered by the Census, solar employment grew 10 times faster than the national average employment rate of 1.9 percent. This growth rate is also significant in that it shows – for the first time ever – the solar industry exceeded the growth projections made in the previous year’s report.

Seventy-seven percent of the nearly 24,000 new solar workers since September 2012 are new jobs, rather than existing positions that have added solar responsibilities, representing 18,211 new jobs created.

Wages paid by solar firms are competitive, with the average solar installer earning between $20.00 (median) and $23.63 (mean) per hour, which is comparable to wages paid to skilled electricians and plumbers and higher than average rates for roofers and construction workers. Production and assembly workers earn slightly less, averaging $15.00 (median) to $18.23 (mean) per hour, slightly more than the national average for electronic equipment assemblers.

The solar industry is a strong employer of veterans of the U.S. Armed Services, who constitute 9.24% of all solar workers – compared with 7.57% in the national economy. Solar employs a slightly larger proportion of Latino/Hispanic and Asian/Pacific Islander workers than the overall economy.

A few years ago, Doug and I got a quote to put solar panels on our rooftop. Enough panels to run all our needs under the roof. The quote was a dizzying $50,000+, but with Federal tax credits it still came to a staggering $35,000.

The Solar Foundation was instrumental in extending the federal solar investment tax credits through 2016. This represented the first long-term tax credit for the solar industry, and has rapidly led to expanding markets, increased jobs and significantly lower costs for solar energy. One of the main reasons more people don’t use solar is a lack of good information. There is also plenty of flat-out incorrect information about solar out there, and as a result many people believe that solar is too expensive or that the technology isn’t ready to provide a significant share of America’s energy needs. Despite this, we believe that millions of Americans are already seeing the facts and realizing full promise of solar energy.

Here’s how the tax credits work:

-

Types

-

You can get a federal tax credit for two kinds of solar-energy systems: photovoltaic systems — that is, solar panels — which convert sunlight into electricity, and solar water heaters. Solar energy systems installed in your primary residence or a second home qualify for the credit, but not those installed in rental properties.

Requirements

-

To qualify for the tax credit, photovoltaic systems must provide electricity for your home; solar panels that generate power for sale to others don’t qualify. The installed solar panels also must meet all local fire and safety codes. Water heaters qualify for the solar energy tax credit if they get at least half of their warming energy from the sun. The system must provide hot water for use inside your home; systems that provide heating for swimming pools and hot tubs are not eligible. Heaters must be certified by SRCC, the Solar Rating and Certification Corp.; any solar water heater that has earned Energy Star classification from the Department of Energy has been SRCC certified.

Amount

-

You can claim a credit for 30 percent of the cost of qualifying solar energy systems — including labor and installation — that you added to your home between January 1, 2006 and December 31, 2016. For systems installed in 2006, 2007 or 2008, the maximum credit is $2,000. For systems installed in 2009 and beyond, there is no maximum credit.

Consideration

-

The federal solar energy tax credit is not “refundable,” meaning that you can use the credit to cut your taxes to zero, but that’s all. So if your income tax liability for the year totals $3,000 and you are eligible for $5,000 worth of solar energy credits, you can only claim a $3,000 credit on that year’s taxes. You can’t claim the whole $5,000 and then get a check back from the government for the extra $2,000. What you can do, though, is “carry forward” the extra credit to future years. That means you can claim the leftover $2,000 on next year’s taxes

Pacific Power’s Blue Sky Grant program funded a $60,000 installation at the Del Norte Triplicate printing plant in Smith River which included 36 solar panels 2013. Their electricity costs shrank from $38/day to $23/day in 2013. Locals, Clark Moore of Alternative Energy Systems, and Dave Restad of Crescent Electric were part of the team that put the project on line.

Today the costs to the average homeowner are still too high to convert to solar power. But if you watch video’s from UTube, you can see everything from painting soda cans to purchasing seconds of photovoltaic cells with instructions on making your own solar powered devices.

Perhaps in the not to distant future, someone will create an industry here to manufacture solar panels and bring the cost within reach of the average home owner (and create more jobs in the process.)

-