Opinion and Commentary By Donna Westfall – February 7, 2026

For several months I’ve been reading snippets about whether or not seniors could be exempted from paying property taxes.

This morning I read and reacted to an email. Author Jenny Huh from ABC10 was on a video and wrote an article dated February 6th with this headline:

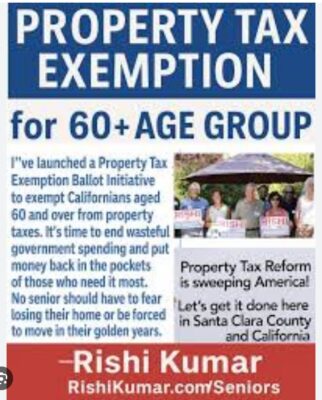

California ballot proposal would exempt seniors from paying property taxes

WHAT? REALLY? HOW?

Looks like there’s an initiative that with enough signatures would put this on the November 2026 ballot. This is very doable. Signatures needed by August 4, 2026 – 875,000. Very doable.

What’s the criteria for becoming exempt?

- You must be at least 60 years old

- Living in your home for 5 years

- Living in California for 10 years

- Home must be your principal residence

So far I’ve learned that 16 other states are doing the same thing. One criteria I’m not sure of is whether or not the home has to be paid for free and clear.

Let’s face it. Seniors living on Social Security are not getting enough in annual cost increases to keep up with all the price increases that affect their lives. Inflation, even as low as it is under Pres. Trump, still impacts so many aspects of their lives.

The proponent of this initiative is Rishi Kumar. He’s a Democrat. Be still my heart. I can’t believe a Democrat is for reducing a tax base, but let’s give him credit for pursuing this.

This afternoon I’m going to try to obtain a copy of the actual initiative. Read it thoroughly. Analyze it and then if it seems kosher, make copies and start getting signatures. If Kumar is smart, he’ll push for 1 million signatures because you know darn well that thousands will be kicked out.