Opinion and Commentary By Donna Westfall – April 19, 2024

A Taxpayer Revolt Passed Prop 13 in 1978. Ever since then, our California politicians have been trying to play havoc with Prop 13 making it necessary for push-back from taxpayers. Looks like this November may be the 2nd taxpayer revolt.

But it’s not just Prop 13, but in our area of the world, it’s the 1% sales tax put into place both in the County and in the City. We all know that they will put on a good show about how necessary it is to have that money in their hot little hands. After all, don’t we need to protect our emergency services?

Then there’s the Benefit Assessment for the Crescent Fire Protection District of $74 per property to be added to the $24 passed in 1987 on our property taxes.

Not to be outdone, the City will probably try to increase sewer rates in the next few months.

Whatever happened to living within a budget. If families have to do it, so should our government. Instead, it seems as soon as a tax is passed by the voters, government employees get raises and new people are hired.

Yesterday, Jaime Yarbrough and I met with Vanessa Duncan, Administrative Specialist and Fire Chief Kevin Carey at the Crescent Fire Protection District Hall. They wanted to understand why we want to repeal the Benefit Assessment tax attached to our property tax bill. And then asked about our objections and if we had any solutions; so here goes:

1.) No sunset clause.

2.) While property owners are paying the tax, those that call for mostly health/medical related calls are not necessarily property owners and don’t pay the tax.

3.)Suggest going before the BOS and have something about their health insurance reimbursing the Fire District.

4.) We’re taxed enough already. It only adds to Cost of Living and Inflation.

5.) Hard to justify $1/4 mil for Fire Chief or any city/county employees.

6.) May have a problem with dispatch sending every unit in the city/county to every call.

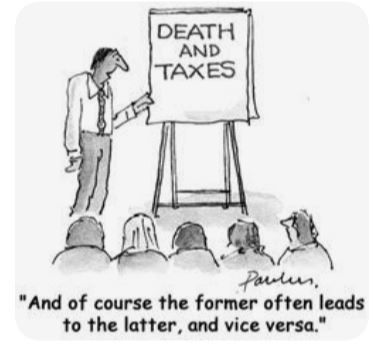

Why Is it so difficult to understand that we are being taxed to death?

Sam Strait is vacationing on a little island called Niue. Niue is a self-governing state in free association with New Zealand, an arrangement dating from October 1974. Niueans are New Zealand citizens.

Sam, ever curious, writes:

“I am currently on an island that is self governed. They have a fire department stationed at the airport, which consists of one firetruck and one rescue truck, both relatively new. They have four paid fire positions, one is considered the lead position. Beginning positions start at 11$NZ per hour or about $7 US. They are paid for a thirty two hour work week whether they fight a fire or not. Most houses are stone or cement, so house fires are rare. Their biggest responsibility is on plane day at the airport. THEY COVER THE ENTIRE ISLAND, sized about half of Del Norte County. Their entire budget is less than Chief Carey’s salary and benefits for an entire year. The hospital ambulance takes medical calls and the police handle rescues. The local people are also involved in many of these situations for added support. The local government has recognized that they have only so much to spend each year and fires represent only a very tiny portion of the needs of the community, such that they spend accordingly. If the fire department responded to a greater number of fire calls they would likely spend accordingly, they do not; hence, the Fire department for the whole island is very small.“

“One other thing of note, is that there is no insurance for your house, period. You take your chances if for whatever the cause you loose your house. It is on you to rebuild. Insurance for anything is a rather loose concept. Makes a person considerably more likely to build better and drive more carefully. Kind of like being responsible for your actions. What a concept. Much of this reluctance for a more comprehensive government comes from how the island was settled about 3,000 years ago. It seems to have survived rather well all things considered as time and circumstance evolved. The Country’s government only provides those services that are absolutely necessary and a large over bearing fire department is not one of them.“

Is the real question: Has government made us so reliant on them that we no longer can take personal responsibility for our lives?

I would like to find ways to reduce my property tax bill on my Crescent City home. It is now $750 a year which seems rather high for a 1000 sq ft house.

While you are trying to reduce your property tax bill, the local school district has declared open season on you and all other parcel owners. They are set to place a $44 million dollar bond measure on November’s ballot. Those that rent should be aware that landlords will be forced to raise your rent should this pass. The current excuse is the woefull lack of maintenence that the school district has employed for years, while paying teachers and administrators more and more with little discernable results when it comes to quality of educational outcomes. They will claim that the money raised will pay for all kinds of essential repairs just like in 2008 as they blew through the $25 million in bond funding with little to show for it, all the while claiming a citizen’s oversight committee was making sure it was properly spent. What a joke! Most of the time the committee either didn’t exist as a functional committee, or relied on the district to tell them everything was okay when it wasn’t. The same promises made in 2008 are already being used by the district in the last few months to gin up support for the passage of the bond in November. First a survey to claim that there is support for the bond. Then, the claim of an oversight committee that will keep the money from being wasted. And finally they are going to say by “doing this now” the district will be able to magically leverage the $ 44 million into $50 or $60 more millions from State grant funding, something that never happened last time around. The one other thing to keep in mind is that the $25 million in bond funding from 2008 will cost locals close to $50 million to pay it off and we are fourteen years away from doing that. The new bond ask from the district will be even more expensive because interest rates have increased substantially over the last few years so that the repayment of the new bond if it passes will be more like $100 million to repay the debt over thirty years. Fourteen years will be concurrent with the 2008 bond repayment. When you add all the other taxes that have been deceptively wrangled out of a deceived local public, mounting to thousands of dollars per year, from which we have little to show for it. Perhaps it is just time to say “NO” to the school district in November and to clean up their house first. Then in November vote to get rid of a slew of taxes already on the books to be voted on that have gotten us nothing but empty pockets and nothing to show for it.

This is all so correct, people please, if your going to complain about taxes and the cost of living think about the way you vote.