By Donna Westfall – December 19, 2021

Last year when both the City and the County put a 1% sales tax on the ballot, many of us thought they were nuts. Could the timing be any worse?

Worse or not, there is possible recourse at the June ballot in 2022 IF enough signatures are collected and verified.

Signatures needed on the County Sales Tax Repeal = 416 (both county and city registered voters can sign.) ALL SIGNATURES HAVE TO BE ORIGINAL..

Signatures needed on the City Sales Tax Repeal = 49 (only city registered voters can sign). ALL SIGNATURES HAVE TO BE ORIGINAL.

These are not huge numbers. It’s very doable.

The deadline: County Clerk, Alissia Northrup would prefer they were in by January 27, 2022.

They have 30 days in which to verify that the signatures are registered voters. Usually 20% more signatures are collected because you never know why someone’s signature would be rejected. Maybe they moved and didn’t re-register. Maybe they are ill and their signature doesn’t match the one that’s on file.

That means signature gathers will shoot for 500 signatures on the County petitions and minimum of 60 on the City petitions. just to be sure.

Besides the sales tax issue, there’s also the Repeal of the Death Tax that’s a statewide petition. Ads are paid for the Howard Jarvis Taxpayers Association. It’s to protect Prop 13.

Then there’s the School Choice petition. If you’re a parent, grandparent or taxpayer that’s unhappy with the education children are receiving in the public schools; and if this gets to the ballot and passes, parents would be in the position to decide what is best for their kids education. Private School, parochial school or home schooling. Nice choices when tax dollars would be utilized.

One of the reasons for supporting this School Choice is to weaken the stranglehold the Teacher’s Union has on public education. About 1,000 students have been yanked out of the Del Norte County public school system. Parents and children realized that they could get a better education at home due to Covid and it’s craziness. It was hard to anticipate when schools would be open last year.

Currently, on another tax repeal, a Notice of Intent was delivered to the Fire District on Washington Boulevard two weeks ago regarding the repeal of a badly written tax. Their attorney is supposed to prepare a Title and Ballot Summary within 15 days of receipt. That should be coming out in this upcoming week and then it gets published in the Triplicate. Once published, the actual petition gets prepared and both the proof of publication and the petitions are dropped off at the Fire District for approval. Once approved, the petitions get circulated for signature. ALL SIGNATURES NEED TO BE ORIGNAL.

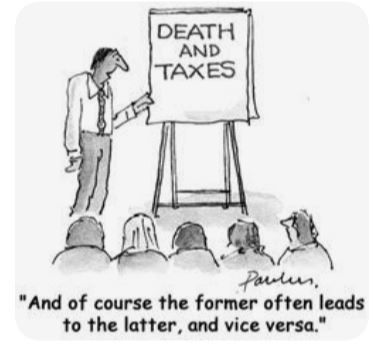

It’s quite a process, but if you’re feeling taxed to death just know there people in the community working at limiting government spending. Keep in mind, these funds go into the General Fund. Even though each agency promotes the concept that the funds will be carefully watched, we’ve learned from the $25 million School Bond Citizens Oversight Committee (COC) that our tax dollars are NOT carefully watched. It’s been more of a rubber stamp group over the last 12 years. Add to that the School Board wants another $47 million School Bond voted on in 2022.